Ever filled a prescription and been shocked by the price - even though your plan says it covers the drug? You’re not alone. The reason? Your insurance plan uses something called a formulary tier system to decide how much you pay. It’s not random. It’s a carefully designed structure that can save you money… or cost you a lot more than you expected.

What Exactly Is a Formulary Tier?

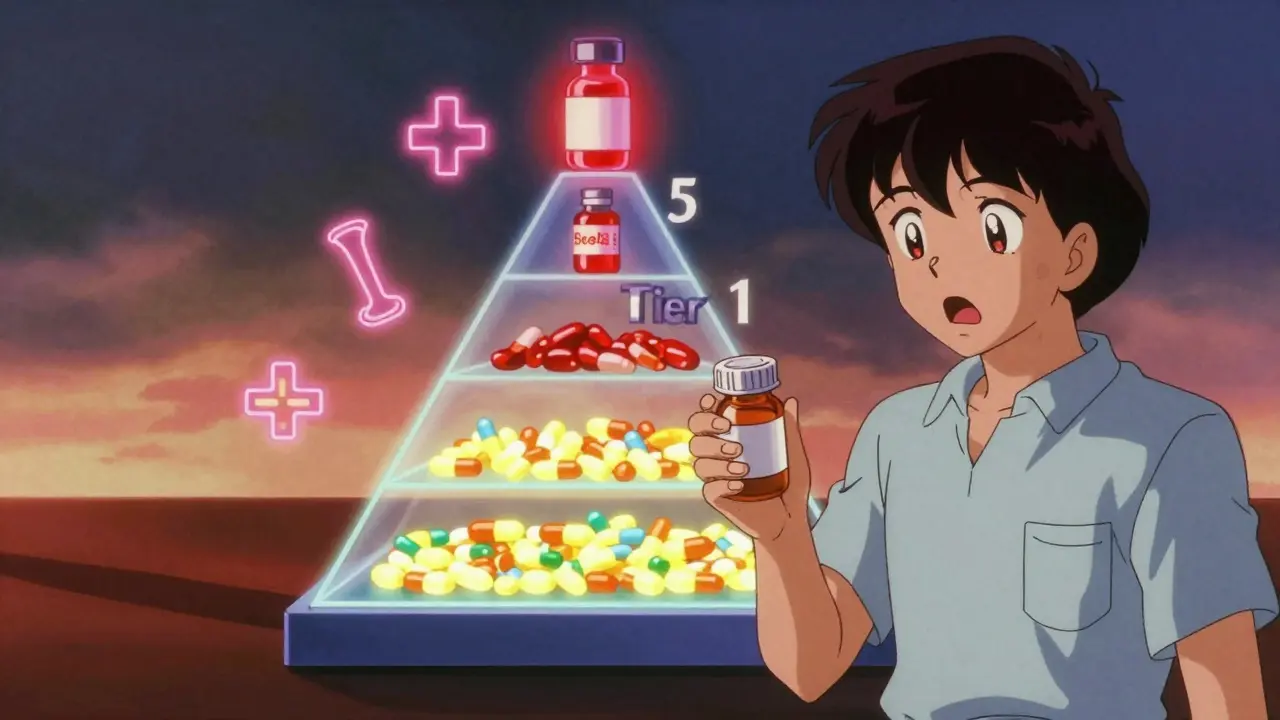

A formulary is just a list of drugs your insurance plan agrees to cover. But not all drugs are treated the same. That’s where tiers come in. Think of tiers like levels in a video game - the lower the tier, the cheaper it is for you. Higher tiers mean higher out-of-pocket costs. Most plans use three to five tiers. Each one groups drugs by cost, effectiveness, and whether a generic version exists. The goal? Encourage you to pick cheaper, equally effective options. But it’s not always that simple. Sometimes the drug you need is stuck in a high tier - or not covered at all.Tier 1: The Lowest Cost - Usually Generics

Tier 1 is your best friend when it comes to drug costs. This tier is almost always filled with generic medications - the same active ingredients as brand-name drugs, but way cheaper. Why? Because generics don’t carry the marketing and research costs of new drugs. In most commercial plans, a 30-day supply of a Tier 1 drug costs between $0 and $15. For Medicare Part D, it’s often just $0 or $5. Common examples? Lisinopril for high blood pressure, metformin for diabetes, or atorvastatin for cholesterol. These are the drugs your doctor likely prescribes first - not just because they work, but because they’re affordable. The kicker? If your plan covers a generic version of a drug you’re used to, they’ll push you toward it. That’s not a bad thing - unless you have an allergy or side effect. Then you’ll need to ask for an exception.Tier 2: Preferred Brand-Name Drugs

Tier 2 is where you find brand-name drugs that your insurer has negotiated lower prices for. These aren’t generics, but they’re still considered cost-effective - either because they have good clinical results, or because the drugmaker gave the insurer a big rebate. Copays here usually range from $20 to $40 for a 30-day supply. Examples include popular brand-name drugs like Lipitor (atorvastatin - yes, even though a generic exists, some plans still list it here), Humira for arthritis, or Saxenda for weight loss. Here’s the thing: if a generic version becomes available, your insurer might move the brand-name drug from Tier 2 to Tier 3. That’s legal. And it happens more often than you think. You might get a notice. Or you might not. Always check your formulary before refilling.Tier 3: Non-Preferred Brand-Name Drugs

Tier 3 is where things start to hurt. These are brand-name drugs without generic alternatives - or ones that insurers don’t prefer because they’re more expensive than similar options. Copays here jump to $50-$100. Some plans even use coinsurance - meaning you pay a percentage (like 30%) of the drug’s total cost. For a $300 drug, that’s $90 out of pocket. Ouch. Common Tier 3 drugs? Drugs like Ozempic (semaglutide) for diabetes and weight loss, or certain cancer treatments that don’t yet have generics. If your doctor prescribes one of these, you’ll need to ask: Is there a cheaper alternative? Can we try Tier 2 first? And yes - insurers can move drugs into Tier 3 at any time. You might be on a drug for years, then get a letter saying your copay just doubled. No warning. No explanation. Just a higher bill.

Tier 4 and Tier 5: Specialty Drugs - The Real Cost Shockers

Not all plans have five tiers. But if yours does, Tier 4 and Tier 5 are for specialty medications - high-cost, complex drugs used for serious conditions like cancer, multiple sclerosis, rheumatoid arthritis, or rare genetic disorders. These aren’t simple copays. They’re usually coinsurance - meaning you pay 25% to 50% of the drug’s total price. A single dose of a specialty drug can cost $5,000 to $20,000. So your share? $1,250 to $10,000 per month. That’s not a typo. Some plans put all specialty drugs in one separate tier. Others split them into Tier 4 and Tier 5 based on cost. Humana, for example, puts drugs over $1,000 per month in Tier 5 - requiring 34-50% coinsurance. The problem? Many patients delay or skip these drugs because they can’t afford them. A 2022 survey found 41% of people with chronic conditions skipped doses or didn’t fill prescriptions because of high Tier 4/5 costs. That’s not just inconvenient - it’s dangerous.Non-Formulary Drugs: Not Covered at All

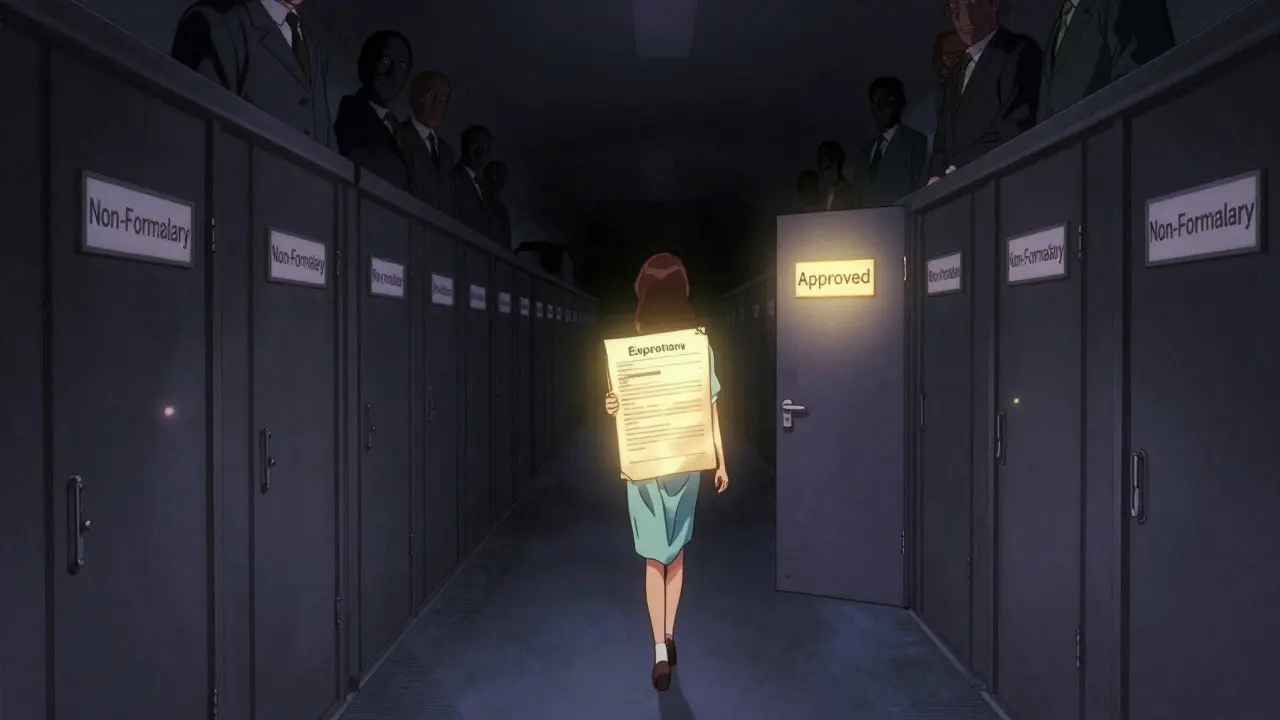

Then there’s the black hole: non-formulary drugs. These are medications your plan doesn’t cover - period. Not even a little bit. Why? Maybe the drug is new and hasn’t been reviewed yet. Maybe it’s expensive with no proven advantage over cheaper alternatives. Or maybe your insurer just doesn’t want to pay for it. If your doctor prescribes a non-formulary drug, you’ll pay full price - often hundreds or thousands of dollars. No insurance help. No discount. Nothing. But here’s your lifeline: you can request a formulary exception. Your doctor writes a letter explaining why you need this specific drug - not a cheaper alternative. Maybe you tried others and had side effects. Maybe the cheaper one doesn’t work for your condition. The process takes about 7-10 days. If approved, your drug might move to a lower tier. If denied, you can appeal. Many people win their appeals - especially with strong medical documentation.Why Do Formulary Tiers Change So Often?

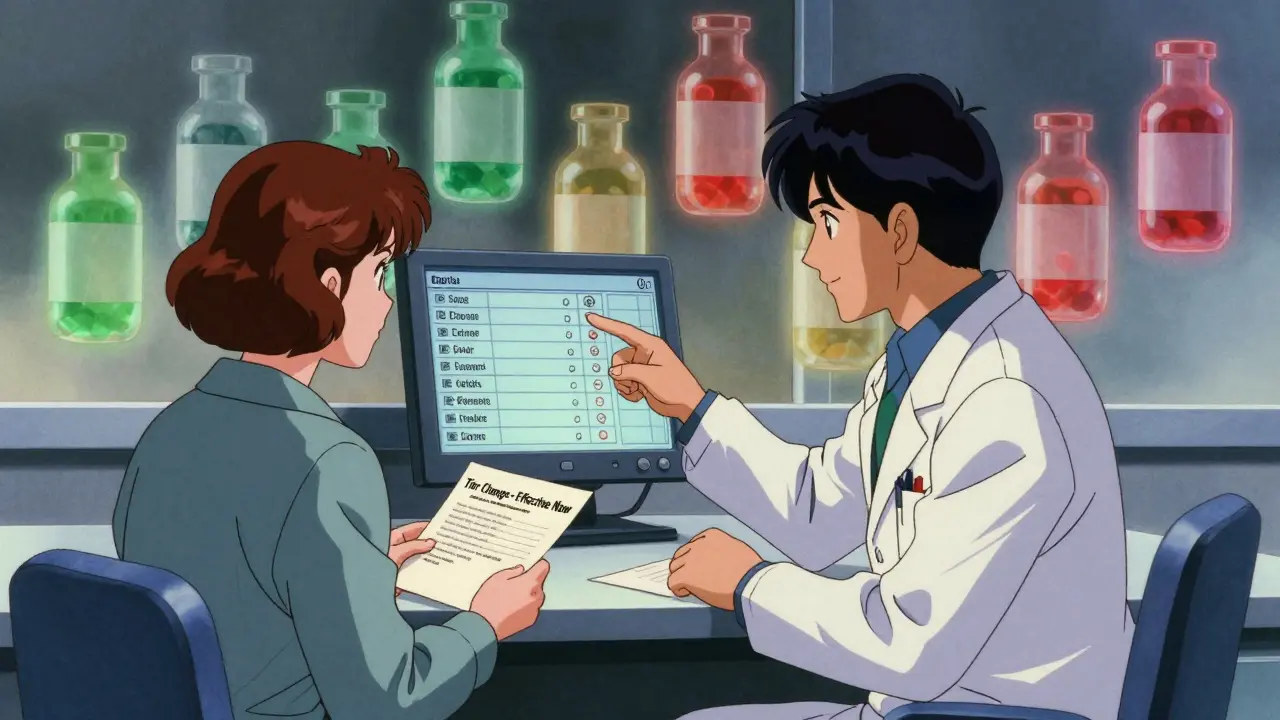

You might be on a Tier 2 drug for two years. Then, one day, your copay jumps to Tier 3. Why? Because formularies are updated quarterly. And they’re managed by Pharmacy Benefit Managers (PBMs) - big companies like CVS Caremark, Express Scripts, and OptumRx. These companies negotiate rebates with drugmakers. If a drugmaker stops offering a big discount, the drug gets moved up a tier. If a cheaper generic hits the market, the brand-name version gets demoted. The system is designed to save money - for insurers. But it doesn’t always save money for you. And here’s the worst part: you rarely get advance notice. A 2022 Kaiser Family Foundation survey found 43% of people had at least one drug moved to a higher tier during the year - without warning.How to Protect Yourself

You can’t control your insurer’s decisions. But you can control how you respond.- Check your formulary before your doctor writes a script. Go to your plan’s website. Search for the drug. See what tier it’s on.

- Ask your doctor: “Is there a Tier 1 or Tier 2 alternative?” They’re not always aware of your plan’s formulary. Give them the info.

- Use cost tools. Medicare has a Plan Finder. Humana, UnitedHealthcare, and others have drug cost calculators. Plug in your drug and your zip code. See what you’ll pay.

- Know the difference between copay and coinsurance. A $40 copay is predictable. 30% coinsurance on a $1,200 drug? That’s $360. Big difference.

- Request an exception if you need it. Don’t assume you’re stuck. Submit paperwork. Get your doctor involved. You have rights.

- Track changes. Every January, your plan sends a new formulary. Save it. Compare it to last year’s.

The Bigger Picture: Is This System Fair?

Formulary tiers were created to lower overall drug spending. And they’ve worked - for insurers. Since 2006, Medicare Part D saved over $200 billion thanks to tiered formularies. But the cost is carried by patients. A 2021 study in JAMA Internal Medicine found that each additional tier increases the chance you’ll skip your meds by 5.7%. For low-income people, that number is even higher. And the lack of transparency? It’s a mess. Only 32% of plans explain why a drug is placed in a certain tier. You’re left guessing - and paying more. The Inflation Reduction Act of 2022 tried to fix some of this. Now, insulin costs $35 for Medicare patients - no matter the tier. That’s a win. But it’s just one drug.What’s Next for Formulary Tiers?

By 2025, more plans will use value-based tiering - meaning drugs are ranked not just by price, but by how well they actually help patients. That could be a game-changer. Some insurers are already testing it. CVS Caremark launched diabetes-specific tiers in 2023, grouping drugs by outcomes - not just brand vs. generic. But until then? You’re still stuck navigating a system designed by corporations - not doctors or patients. Your best tool? Knowledge. And asking questions.Frequently Asked Questions

What’s the difference between Tier 1 and Tier 2 drugs?

Tier 1 drugs are usually generic medications with the lowest copay - often $0 to $15. Tier 2 drugs are brand-name medications that your insurer has negotiated a lower price for, with copays typically between $20 and $40. Tier 2 drugs don’t have generics yet, or your plan considers them cost-effective despite being brand-name.

Can my insurance move a drug to a higher tier without telling me?

Yes. Insurers can change formulary tiers quarterly. While some send notices, many don’t. You might only find out when you go to fill your prescription and get hit with a higher price. Always check your plan’s formulary before refilling, especially in January when new plans start.

What if my drug is non-formulary?

If your drug isn’t on the formulary, you’ll pay full price. But you can request a formulary exception. Your doctor must write a letter explaining why you need this specific drug - for example, if other drugs caused side effects or didn’t work. If approved, your plan may cover it at a lower tier. Appeals are often successful with strong medical documentation.

Are all generic drugs in Tier 1?

Almost always. Tier 1 is reserved for preferred generics. But in rare cases, a generic might be placed in Tier 2 if it’s newly approved or if the insurer has a special agreement with the manufacturer. Always double-check your plan’s formulary - not all generics are treated equally.

Why do some plans have five tiers and others only three?

Plans with more tiers - usually employer-sponsored or large commercial plans - use them to create finer cost controls. Five tiers let insurers push patients toward the cheapest options by making higher-tier drugs significantly more expensive. Medicare Part D plans mostly use four tiers. Three-tier plans are simpler and often preferred by consumers - 68% of people are satisfied with three-tier systems versus only 49% with five-tier ones.

How can I find out what tier my drug is on?

Log in to your insurance plan’s website and search their formulary list. Most have a searchable drug database. You can also call the customer service number on your insurance card. For Medicare, use the Medicare Plan Finder tool. Don’t rely on your pharmacist alone - they may not know your plan’s exact tier structure.

Next Steps: What to Do Right Now

- Go to your insurer’s website. Search for your top 3 medications. Note their tiers.

- If any are in Tier 3 or higher, talk to your doctor about alternatives.

- Set a reminder for January - that’s when formularies change. Check again.

- If you’re on a specialty drug and can’t afford it, contact your plan about financial assistance programs.

- Save your formulary document. Print it or screenshot it. You’ll thank yourself later.

Insurance formulary tiers aren’t going away. But you don’t have to be confused by them. Understand the system. Ask the right questions. And don’t accept a surprise bill without fighting back.

11 Comments

I literally cried when my insulin jumped to Tier 4 last year. 😭 I had no idea my plan could do that without warning. Now I screenshot every formulary update. Save your sanity, folks.

Honestly, I didn't even know tiers existed until my copay for my blood pressure med went from $10 to $75. My pharmacist finally explained it. Now I always ask my doc: 'Is there a Tier 1 option?'

People complain about tiered formularies like it's a conspiracy. But if everyone just took generics like they're supposed to, we wouldn't need this system. It's not evil-it's economics.

This is why I refuse to use insurance. Pay cash for everything. My metformin costs $4 at Walmart. My lisinopril is $3. Why are we letting corporations play Russian roulette with our health?

I've been working in healthcare for over 20 years, and I still find formularies confusing. I always tell my patients: write down your meds, check your plan’s website every January, and don't be afraid to ask for help. You're not being difficult-you're being responsible. 🙏

It's fascinating how we've turned medicine into a tiered subscription model. We're not buying drugs-we're buying access. And access is determined by profit margins, not physiology. The system doesn't care if you live or die. It only cares if you're profitable.

I used to be one of those people who just paid whatever they charged. Then my wife got diagnosed with MS and we got hit with a $9,000 monthly coinsurance bill. We fought it. We got the drug moved to Tier 4 instead of 5. It took 6 weeks, 3 letters, and a call from her neurologist. But we won. Don't give up.

The article incorrectly states that Tier 1 drugs are 'almost always' generics. In fact, some plans place certain brand-name drugs in Tier 1 as part of a rebate agreement. The terminology is misleading.

In India, we don't have these tiers. You pay what the pharmacy says. But I know people in US who struggle. My cousin lost his job and couldn't afford his diabetes meds. He switched to insulin from a local pharmacy for $20/month. You can find ways. Don't lose hope.

Stop complaining. Insurance isn't supposed to pay for everything.

I just checked my formulary... and my Ozempic? Moved from Tier 3 to Tier 5. 😳 That’s a $2,100 jump. I called my insurer. They said 'it was effective 1/15.' I didn’t get a letter. No email. Nothing. I’m filing a complaint. And I’m telling my doctor to switch me. This is unacceptable.