Brand-name drugs can cost hundreds or even thousands of dollars a month. If you're paying out of pocket, that’s a heavy burden-especially when a cheaper generic version exists. But here’s the catch: if you have private insurance, you might be eligible for manufacturer savings programs that slash your costs by 70% to 85%. These aren’t scams or gimmicks. They’re real, legal, and widely used-by nearly one in five people with private insurance. The question isn’t whether they work. It’s whether you’re using them correctly.

What Are Manufacturer Savings Programs?

These are financial help tools created by drug makers like AbbVie, Eli Lilly, and Novo Nordisk to reduce what you pay at the pharmacy for brand-name medications. There are two main types: copay cards (or coupons) and patient assistance programs (PAPs). Copay cards are for people with private insurance. PAPs are for those with little or no income, or no insurance at all. Both cut your out-of-pocket cost dramatically.For example, a diabetes patient on Jardiance might pay $562.50 a month without help. With the manufacturer’s copay card, that drops to $100. That’s not a typo. That’s the norm for many high-cost brand drugs.

These programs exploded after 2005, as insurance plans started shifting more costs to patients. By 2023, 19% of all prescriptions for privately insured patients used these programs. That’s $23 billion in savings flowing from drug makers directly to patients. But here’s the twist: these programs aren’t just about helping people. They’re also business tools. Drug companies use them to keep patients on expensive brand drugs instead of switching to cheaper generics.

Who Can Use These Programs?

Not everyone qualifies. The biggest rule? You must have private insurance. If you’re on Medicare, Medicaid, or any other federal health program, you’re excluded. That’s because federal law bans drug makers from giving discounts to people on government plans-it’s seen as an illegal kickback that could push people toward pricier drugs.So if you’re on an employer-sponsored plan, a plan from the Health Insurance Marketplace, or even COBRA, you’re likely eligible. But if you’re on Medicare Part D, you can’t use these cards-even if your plan doesn’t cover the drug well. There are exceptions for PAPs if you’re low-income, but those are separate programs with different rules.

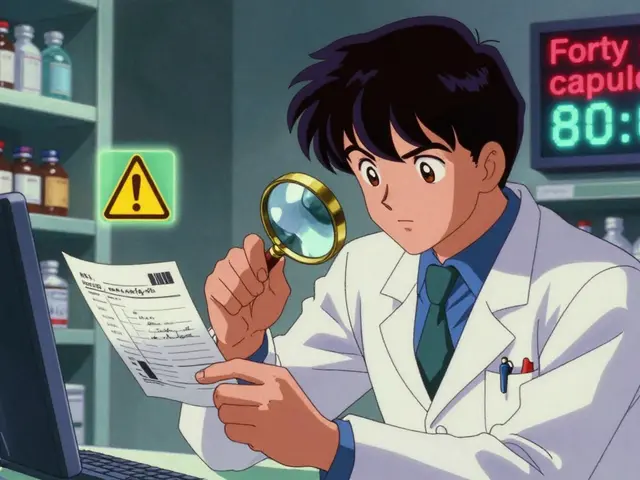

Some plans also have something called an accumulator adjustment program. That means even if your copay card pays part of your bill, the manufacturer’s contribution doesn’t count toward your deductible or out-of-pocket maximum. So you might pay $50 a month thanks to the card, but your deductible still says $0. That’s a trap. Many people don’t realize it until they hit their annual limit and get hit with a huge bill.

How to Find Your Drug’s Savings Program

Start with the drug’s manufacturer. Go to their official website and search for “patient assistance,” “copay card,” or “savings program.” Most big drug companies have a dedicated page. For example:- Humira → AbbVie.com/patients

- Trulicity → EliLilly.com/patient-support

- Ozempic → NovoNordisk.com/patient-support

If you’re not sure who makes your drug, check the label or ask your pharmacist. You can also use free tools like GoodRx or NeedyMeds. GoodRx found that 73% of major drug makers have their own savings portals. But don’t rely on third-party sites alone-they might not show the full picture.

Once you find the right page, you’ll fill out a short form. You’ll need:

- Your name and contact info

- Your insurance details (plan name, member ID)

- Your doctor’s name and prescription info

After submitting, you’ll get a digital card via email or text. Some programs mail a physical card. You can also download the card to your phone wallet. That’s what you show at the pharmacy.

How It Works at the Pharmacy

You don’t pay the full price and get reimbursed later. The discount happens right at the counter. When you hand over your insurance card and your manufacturer savings card, the pharmacy’s system sends both to a third-party administrator (TPA) like ConnectiveRx or Prime Therapeutics. That company checks:- Is your insurance valid?

- Are you eligible for the program?

- Has your annual cap been reached?

If everything checks out, the TPA applies the discount and bills the manufacturer for the difference. You pay only your reduced copay. No waiting. No paperwork. No surprise bills.

But here’s where things get messy: not all pharmacies are in the network. Some independent or small chains don’t process these cards. Always ask your pharmacist ahead of time: “Do you accept this manufacturer’s copay card?” If they say no, go to a CVS, Walgreens, Rite Aid, or another major chain-they almost always do.

What Are the Limits?

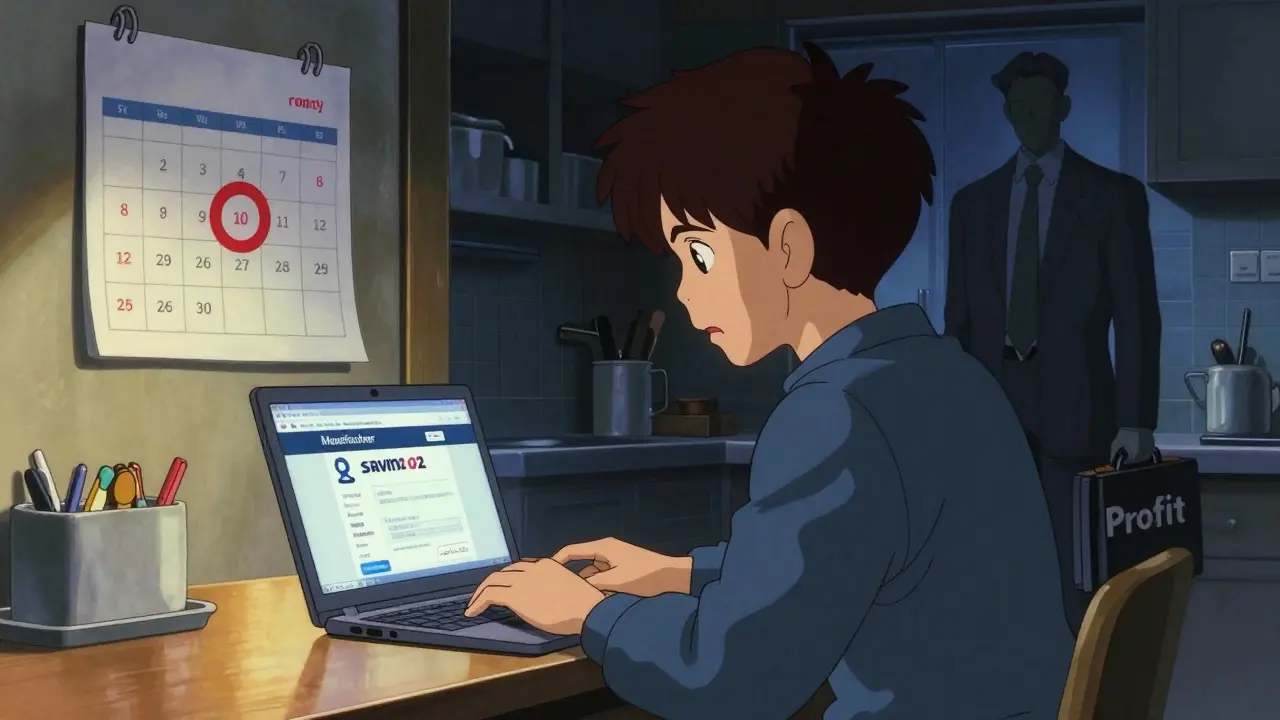

These programs aren’t unlimited. Most cap annual savings between $5,000 and $15,000 per person. That sounds like a lot-until you’re on a $1,200-a-month drug. For example, if your monthly cost is $1,200 and the card covers $1,100, you’re using up $13,200 in savings in a year. That’s over the cap. After that, you pay full price again.Programs also expire. Most last 12 to 24 months. You’ll need to reapply. Some send reminders. Some don’t. If you forget, your cost could jump overnight. One Reddit user shared how their Humira coupon ended without warning. Their bill went from $100 to $1,200 in one month.

And remember: if your plan has an accumulator program, your savings don’t count toward your deductible. That means you might pay $50 a month for a year, but still owe $5,000 more to hit your out-of-pocket maximum. That’s a hidden trap. Always ask your insurer: “Does my plan allow manufacturer coupons to count toward my deductible?” If they say no, you’re playing a different game.

Manufacturer Programs vs. GoodRx or Other Discount Cards

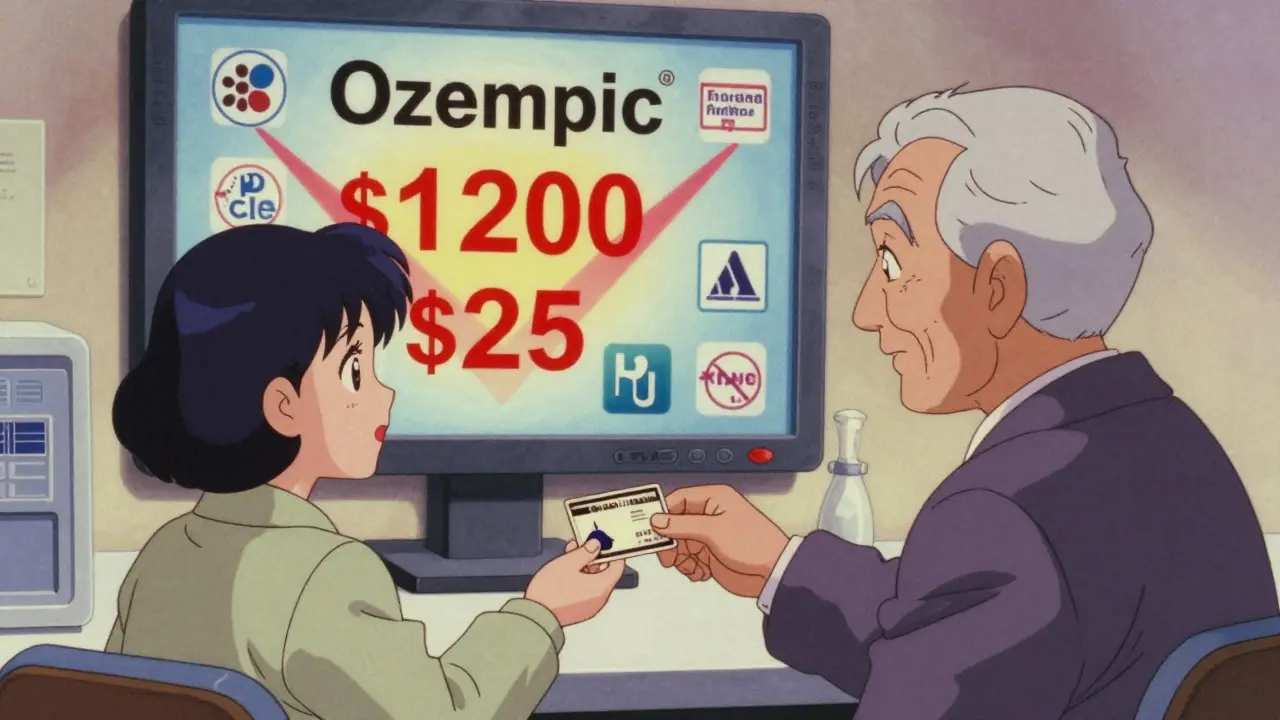

GoodRx, SingleCare, and similar cards are great-but they’re not the same. These cards work for both brand and generic drugs. They offer 30% to 60% off list prices. Manufacturer cards? They offer 70% to 85% off-and only for brand-name drugs.So if you have a generic alternative, GoodRx might be cheaper. But if there’s no generic, or your doctor insists on the brand, the manufacturer card wins. For example, Ozempic has no generic. GoodRx might bring it down to $800. The manufacturer card? $25. That’s the difference between a big discount and life-changing savings.

But here’s the downside: manufacturer cards hurt generic competition. A 2016 study found that when these cards are available, brand drug sales jump by 60% or more. That means fewer people switch to cheaper options. That’s good for the drug maker. Not always good for the system.

Real Stories: What Patients Actually Experience

People on Reddit, Drugs.com, and patient forums share consistent stories:- 78% say they cut their monthly cost from $450 to $50-$100.

- 42% say their insurance plan blocked the card or didn’t count it toward their deductible.

- 28% say the program ended without warning.

One user on r/healthinsurance wrote: “I used my Jardiance card for 18 months. Then I got a letter saying it was ending. My bill jumped from $98 to $562. I had to call my doctor and ask for a different drug. I was lucky I had options.”

Another said: “My pharmacist helped me enroll. I didn’t know where to start. Without her, I’d still be paying $700 a month.”

That’s the key: pharmacists are your allies. 65% of patients need help enrolling. Don’t be embarrassed to ask.

What’s Changing? New Rules and Future Risks

The landscape is shifting. In 2022, the Inflation Reduction Act capped insulin costs at $35 for Medicare users. That’s reducing the need for manufacturer coupons for insulin. More states are passing laws to ban accumulator programs. As of 2023, 32 states have done it. But federal law still allows them.There’s also new pressure from Congress. The 2023 Fair Deal for Patients Act would force manufacturers to let their coupons count toward deductibles. If that passes, drug makers might scale back programs-or raise prices even higher to compensate.

The FDA also issued new guidance in 2023, asking manufacturers to be clearer about program limits. No more hiding the fine print.

What You Should Do Right Now

If you’re paying a lot for a brand-name drug, here’s your action plan:- Find out who makes your drug. Check the label or ask your pharmacist.

- Go to the manufacturer’s website and search for “savings program” or “copay card.”

- Check if you have private insurance. If you’re on Medicare or Medicaid, skip this step.

- Call your insurance company and ask: “Do you have an accumulator program?”

- Enroll in the program. Get your card. Save it on your phone.

- Use only pharmacies that accept the card. Ask before you fill the prescription.

- Set a calendar reminder for 11 months from enrollment. You’ll need to reapply soon.

- Check your explanation of benefits (EOB) every month. Make sure the discount applied.

If you’re denied, call the manufacturer’s help line. Sometimes, a human can override a system error. If your plan blocks the card, ask your doctor for a prior authorization for a different drug-or ask if a generic is available.

Final Thought: It’s Not Free Help-It’s Strategic Help

Manufacturer savings programs are powerful. They can save you thousands a year. But they’re not charity. They’re a business strategy. The drug makers profit because you stay on their expensive drug longer. That’s why they’re so aggressive about marketing them.Use them. Take advantage. But don’t assume they’ll last forever. Don’t assume they’ll count toward your deductible. And don’t ignore the fine print. The goal isn’t just to pay less today-it’s to protect yourself from a big bill tomorrow.

For many, these programs are the only way to afford life-saving medication. For others, they’re a temporary fix in a broken system. Either way, if you’re eligible, you owe it to yourself to use them.

14 Comments

Wow. So drug companies are basically bribing people to stay on expensive meds while the system laughs all the way to the bank? Brilliant. I love how capitalism turns suffering into a loyalty program. You’re not saving money-you’re being groomed for lifelong dependency. And don’t even get me started on accumulator programs. That’s not insurance, that’s a trapdoor with a pretty sticker on it.

bro i used this for my ozempic card and it went from $800 to $25... then it expired and i cried in the pharmacy. now im on metformin and my bank account is alive again. 🥲

Just use GoodRx if you can. Simpler.

There’s something deeply human about this whole system-how we cling to these little lifelines because the system refuses to hold up its end. You’re not just saving money-you’re preserving dignity. A $100 copay isn’t a discount, it’s a breath of air after being underwater for years. And yes, the pharma companies profit. But so what? Right now, the only thing that matters is that you’re still here, still breathing, still able to afford your medicine. That’s victory. Don’t let the cynics steal that from you.

copay cards are a scam the pharma bros made up so you dont switch to generics

Okay so imagine this: you’re on a drug that costs $1,200 a month. You get the card, pay $100, feel like a genius. You set a reminder. You tell your friends. You even post about it on Instagram. Then, 11 months later-POOF. The card vanishes. No warning. No email. Just a letter from your pharmacy saying ‘your benefit has expired.’ Suddenly, you’re staring at a $1,100 bill like it’s a horror movie. And your doctor? ‘Oh, we can try a generic.’ But the generic doesn’t work the same. And your insurance? ‘Sorry, you didn’t meet your deductible.’ So now you’re paying full price on a drug you can’t stop taking. And you’re just supposed to… keep going? This isn’t healthcare. This is a rigged game where the house always wins unless you’re lucky enough to have a pharmacist who actually cares.

pharmacist saved my life. literally. asked if they took the card. they did. i cried. thanks, jenny from walgreens 🙏

I just want to say-thank you for writing this. I’ve been struggling with this for years, and I didn’t even know these programs existed. I thought I was just bad at managing money. Turns out, the system was designed to make me feel guilty for needing help. I’m going to enroll today. And I’m telling my sister. And my mom. And my neighbor. This is important. Thank you.

Let’s be real: if you’re on a $1,200 drug and your copay card covers $1,100… you’re not a patient. You’re a walking revenue stream. And the fact that you’re proud of ‘saving’ $1,100 a month? That’s the real tragedy. The system doesn’t want you healthy. It wants you dependent. But hey-use the card. Just don’t forget to hate the machine while you’re at it.

I’m so glad this exists. My cousin in India can’t even imagine this kind of help. Here, we complain about $100 copays. There, people choose between insulin and food. We’re lucky-even with the traps. Let’s not forget that.

It’s fascinating, really-how we’ve turned pharmaceutical aid into a psychological performance art. The ritual of enrollment, the digital card in your wallet, the whispered conversations with pharmacists… it’s not healthcare. It’s theater. And the audience? We’re all complicit. We cheer the discount while ignoring the script written by shareholders.

i just found out my plan blocks the card and i didnt even know?? i thought i was just bad at budgeting 😭 thank you for this post!! going to call my doc tmrw!!

Thank you for the detailed breakdown. This is information that should be standard in every primary care office.

Just a quick heads-up: if you’re on a high-deductible plan, always ask if the manufacturer’s contribution counts toward your out-of-pocket max. If it doesn’t, you’re playing a rigged game. I learned this the hard way-paid $60/month for a year, then got hit with $4,800 in one month. Don’t be me. Ask. Now.