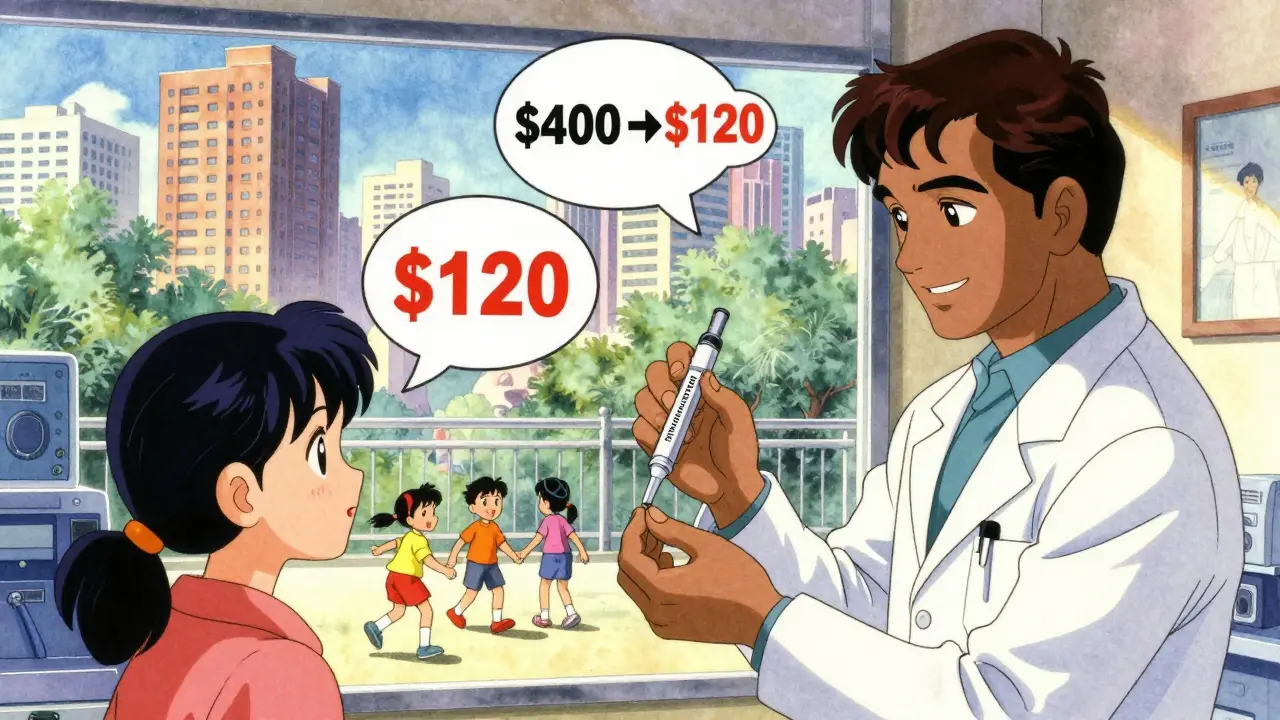

Diabetes affects over 500 million people worldwide, and insulin is one of the most critical treatments. But for many, the cost is impossible to ignore. A single vial of branded insulin can cost over $250 in the U.S., and some patients pay more than $400 a month. That’s why insulin biosimilars are changing the game. They’re not generics. They’re not copies. They’re highly similar, scientifically proven alternatives that can slash costs by 30% or more - without sacrificing safety or effectiveness.

What Exactly Are Insulin Biosimilars?

Insulin biosimilars are follow-on versions of brand-name insulin products like Lantus, Humalog, or Toujeo. But unlike generic pills - which are chemically identical to their originals - insulin is a complex biological molecule made from living cells. That means you can’t just replicate it in a lab like aspirin. Biosimilars are developed using the same living cell lines and manufacturing processes as the original, then tested to prove they work the same way in the body.

The FDA and EMA require biosimilars to match the reference product in structure, purity, potency, and clinical outcomes. Studies show no meaningful difference in how well they lower blood sugar or how often they cause low blood sugar episodes. In fact, a 2025 survey by Research and Markets found that 68% of patients who switched to insulin biosimilars saw no change in their A1C levels or side effects.

Biosimilars vs. Generics: Why It Matters

People often confuse biosimilars with generics. They’re not the same. A generic version of metformin is chemically identical to the brand. You can swap it in without thinking twice. But insulin? It’s a protein with a 3D shape that affects how your body responds. Even tiny changes in manufacturing can alter how the molecule folds or behaves.

That’s why biosimilars go through years of testing: analytical studies, animal trials, and clinical trials in people with diabetes. The goal isn’t to be identical - it’s to be similar enough that the clinical outcome is the same. This level of scrutiny is why biosimilars cost more to develop than generics, but still end up cheaper than the original.

Market Examples: Who’s Making Them and Where?

Several companies are now producing insulin biosimilars. The most widely used include:

- Basaglar - a biosimilar to Lantus (insulin glargine), made by Eli Lilly. It’s approved in the U.S. and EU and has been used by over 500,000 patients since 2016.

- Semglee - another insulin glargine biosimilar, developed by Biocon and marketed by Viatris. It’s the first insulin biosimilar in the U.S. to receive an interchangeable designation from the FDA, meaning pharmacists can substitute it without asking the doctor.

- Fiasp biosimilar - a rapid-acting insulin analog, now available in Europe under brands like Ryzodec biosimilar.

- Hygeia - a biosimilar to Humalog (insulin lispro), approved in the EU and gaining traction in Canada and Australia.

China and India are leading in production volume. India’s Biocon alone supplies biosimilar insulins to over 40 countries. In Mumbai, endocrinologist Dr. Arjun Patel says 45% of his patients now use biosimilar insulins because they’re 60-70% cheaper than branded options.

Cost Savings: Real Numbers, Real Impact

The average selling price for insulin biosimilars in Q1 2025 was $1,840 per unit - about 30% less than the reference product. In the U.S., Medicare and private insurers now reimburse biosimilars at ASP + 8%, which encourages pharmacies to stock them. That’s why one patient, ‘DiabetesWarrior87,’ reported their monthly insulin cost dropped from $450 to $90 after switching to Basaglar.

But savings aren’t automatic. In states where pharmacists can’t substitute biosimilars without a doctor’s note, patients might still get the expensive brand unless they specifically ask for the biosimilar. As of January 2025, only 17 U.S. states allowed pharmacist substitution for insulin biosimilars. In Germany, where substitution rules are looser, biosimilar insulin use jumped 22% in just two years.

Why Adoption Is Still Slow

Despite the savings and proven safety, insulin biosimilars have only captured about 26% of the market after five years - far behind oncology biosimilars, which hit 81%. Why?

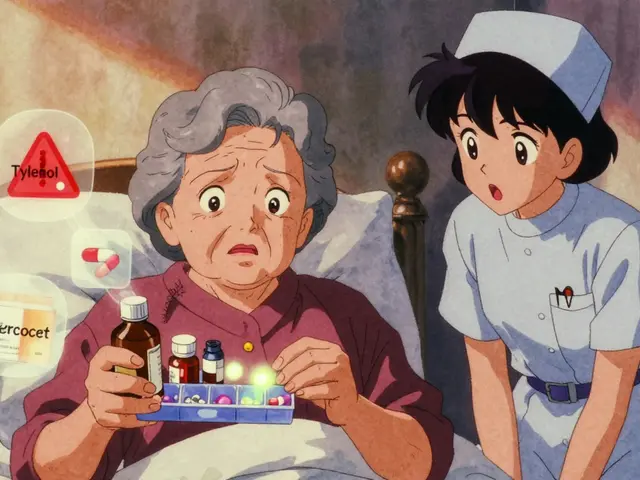

- Patient fear: Many worry switching insulin could cause dangerous lows or highs. One Reddit user reported more frequent hypoglycemia after switching and went back to the original.

- Doctor hesitation: Some providers stick with what they know. A 2025 survey found 41% of endocrinologists still prefer prescribing branded insulin.

- Pharmacy rules: In the U.S., automatic substitution isn’t allowed everywhere. Even if a biosimilar is approved, your pharmacy might not carry it unless your doctor writes for it specifically.

- Marketing power: Sanofi still sells both branded Lantus and an unbranded version at a lower price - keeping many patients on the expensive option without realizing they’re paying more than necessary.

Dr. Robert A. Rizza, former President of Medicine & Science at the American Diabetes Association, put it bluntly: “The clinical equivalence of biosimilar insulins has been well-established. The barriers are perception, not science.”

Switching Safely: What You Need to Do

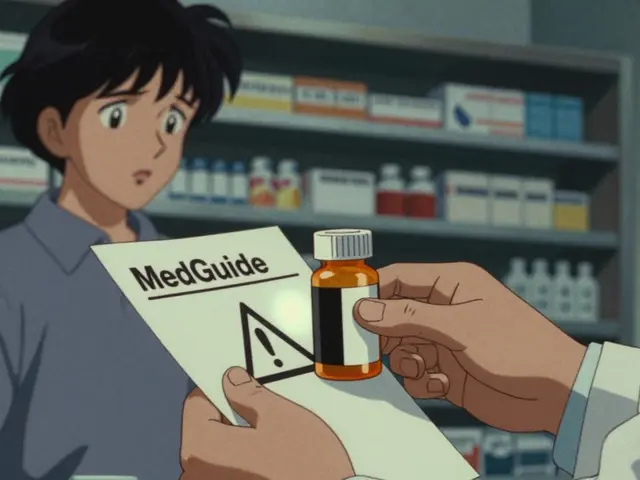

If you’re considering switching, don’t just swap it out. Follow these steps:

- Talk to your doctor. Not all biosimilars are the same. Some have slightly different absorption rates. Your provider should choose one that matches your current regimen.

- Monitor closely. The American Association of Clinical Endocrinologists recommends 3-6 months of frequent glucose checks after switching. Use a CGM if you have one.

- Track your numbers. Record your A1C, average glucose, and hypoglycemia episodes. If things stay stable, you’re good.

- Know your rights. In states with substitution laws, you can ask your pharmacist if a biosimilar is available. In others, you may need a new prescription.

Most patients who switch successfully report no issues. In fact, many say they feel more in control because they’re paying less.

What’s Next? The Future of Insulin Biosimilars

The market is accelerating. The global insulin biosimilar market is projected to hit $5.8 billion by 2035, growing at 6.2% annually - but the insulin segment alone is expected to grow at 18% CAGR, triple the pace of other biosimilars.

New products are coming. By 2026, biosimilars for Toujeo and Tresiba - long-acting insulins with no competition yet - will hit the market. Manufacturers are also bundling biosimilars with smart pens and connected devices. Seventy-eight percent of companies are investing in next-gen delivery systems, which could make dosing easier and safer.

Regulatory alignment is improving. The FDA and EMA are working together to cut approval times by 12-18 months. That means more options will reach patients faster.

Emerging markets will lead adoption. In India and China, where 141 million and 140 million people live with diabetes, respectively, biosimilars are the only realistic path to universal insulin access. By 2030, they could cover 60-65% of insulin use in these regions.

Final Thoughts: It’s Not Perfect - But It’s Progress

Insulin biosimilars aren’t magic. They don’t fix broken healthcare systems. They don’t solve supply chain issues. But they do offer real, measurable relief to millions who choose between food and insulin.

The science is solid. The savings are real. The barriers? They’re mostly about fear, inertia, and outdated policies - not science.

If you’re paying more than $150 a month for insulin, ask your doctor about biosimilars. Ask your pharmacist if one is available. Check your insurance formulary. You might be surprised how much you can save - without risking your health.

Are insulin biosimilars as safe as branded insulin?

Yes. Regulatory agencies like the FDA and EMA require biosimilars to prove they have no clinically meaningful differences in safety, purity, or potency compared to the original insulin. Large clinical trials and real-world data show identical rates of hypoglycemia, weight gain, and blood sugar control. The 2025 Research and Markets survey found 68% of patients experienced no change in side effects after switching.

Can I switch from my current insulin to a biosimilar without my doctor’s approval?

In most cases, no. Even if a biosimilar is FDA-approved as interchangeable, your pharmacist can only switch it automatically if your state allows it. As of January 2025, only 17 U.S. states permit pharmacist substitution for insulin biosimilars. Always talk to your provider first - especially if you’ve had unstable blood sugar in the past.

Why are insulin biosimilars cheaper than the original?

They don’t need to repeat expensive clinical trials because they’re built on existing data from the original product. Instead, manufacturers focus on proving similarity through analytical and pharmacokinetic studies. This cuts development costs by up to 70%. Combined with competition from multiple makers, prices drop significantly - typically 15-30% below the brand.

Do insulin biosimilars work for type 1 and type 2 diabetes?

Yes. Biosimilars are approved for both types. They’re used for basal insulin (like glargine) and bolus insulin (like lispro or aspart). The clinical trials that approved them included patients with both type 1 and type 2 diabetes. The only difference is how they’re dosed - not how they work.

Which countries have the highest use of insulin biosimilars?

Europe leads in adoption, especially Germany and the UK, where substitution policies are more flexible. India and China are growing fastest due to high diabetes rates and government support. In India, over 40% of insulin prescriptions are now for biosimilars. The U.S. has the largest market value ($3.2 billion in 2025) but slower adoption due to fragmented pharmacy rules and brand loyalty.

Are there any insulin biosimilars approved as interchangeable in the U.S.?

Yes. Semglee (insulin glargine) became the first interchangeable insulin biosimilar in the U.S. in 2021. This means pharmacists can substitute it for Lantus without contacting the prescriber - just like a generic drug. Other biosimilars are under review, but the FDA requires additional data to prove interchangeability, including multiple switch studies in patients.

Write a comment