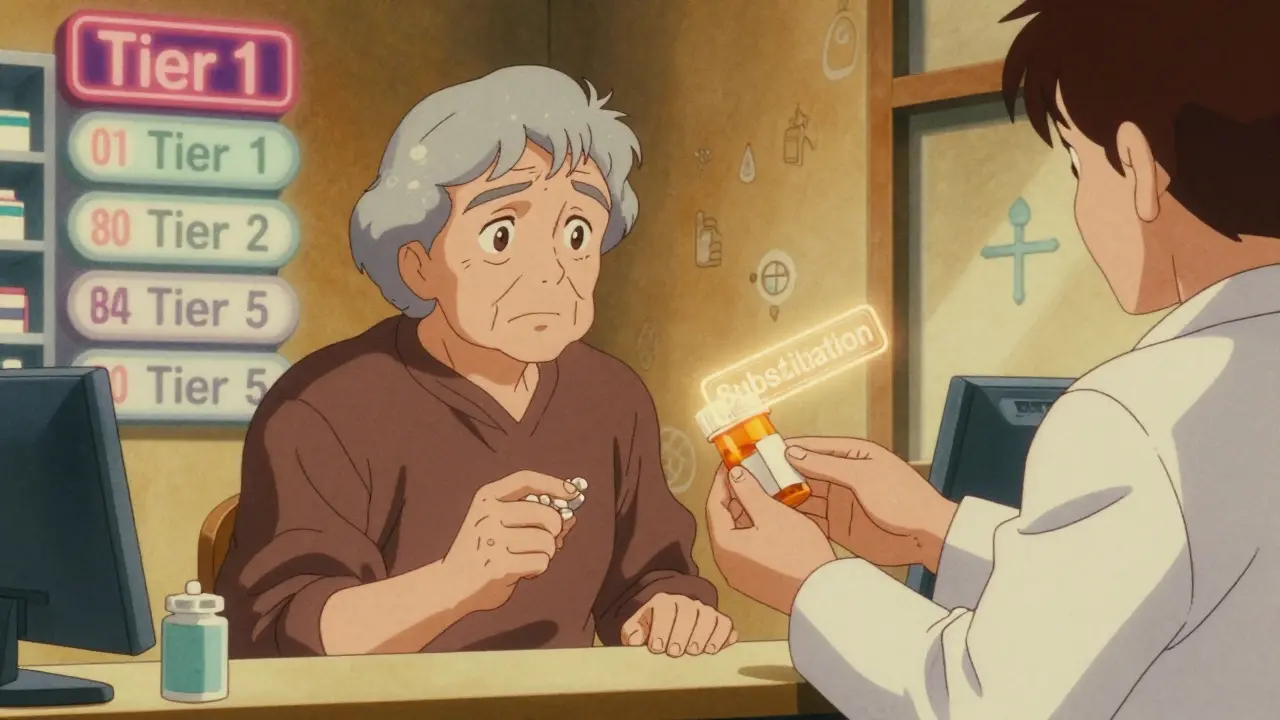

When your pharmacist hands you a different pill than what your doctor wrote on the prescription, it’s not a mistake. It’s Medicare Part D substitution-and it’s happening more often than you think. The rules around what drugs can be swapped, when, and why are buried in fine print, but they directly affect how much you pay and whether your medication actually works for you.

What Is Medicare Part D Substitution?

Medicare Part D substitution means a pharmacist can replace one drug with another that’s considered medically similar-usually a generic version or a different brand in the same class. This isn’t random. It’s guided by your plan’s formulary, which is a list of approved drugs sorted into tiers based on cost. The goal? Lower your out-of-pocket expenses. But it’s not always that simple.

Under federal rules, pharmacists can substitute generic drugs for brand-name ones unless your doctor writes “Do Not Substitute” on the prescription. That’s standard across all pharmacies. But when it comes to swapping one brand-name drug for another, or switching between non-preferred drugs, that’s where your specific Part D plan steps in. Some plans allow therapeutic interchange-swapping one blood pressure pill for another-only if you’ve tried the cheaper option first. Others require prior authorization before any substitution happens.

How Formularies Control What You Get

Your Medicare Part D plan doesn’t cover every drug. It picks which ones to include and puts them into tiers. In 2025, most plans use a five-tier system:

- Tier 1: Preferred generics-lowest cost, often $0-$5 copay

- Tier 2: Non-preferred generics-slightly higher, maybe $10-$15

- Tier 3: Preferred brand-name drugs-$40-$60

- Tier 4: Non-preferred brands and some generics-$70-$120

- Tier 5: Specialty drugs-often hundreds per month, like cancer or autoimmune treatments

If your doctor prescribes a Tier 4 drug, your plan might automatically substitute it with a Tier 2 generic-unless your doctor objects. But if your drug is on Tier 3 and the only available substitute is Tier 4, you’ll pay more. And if your plan removes a drug from its formulary entirely, you could be forced to switch mid-year. That’s why reviewing your plan’s formulary every fall during Open Enrollment isn’t optional-it’s essential.

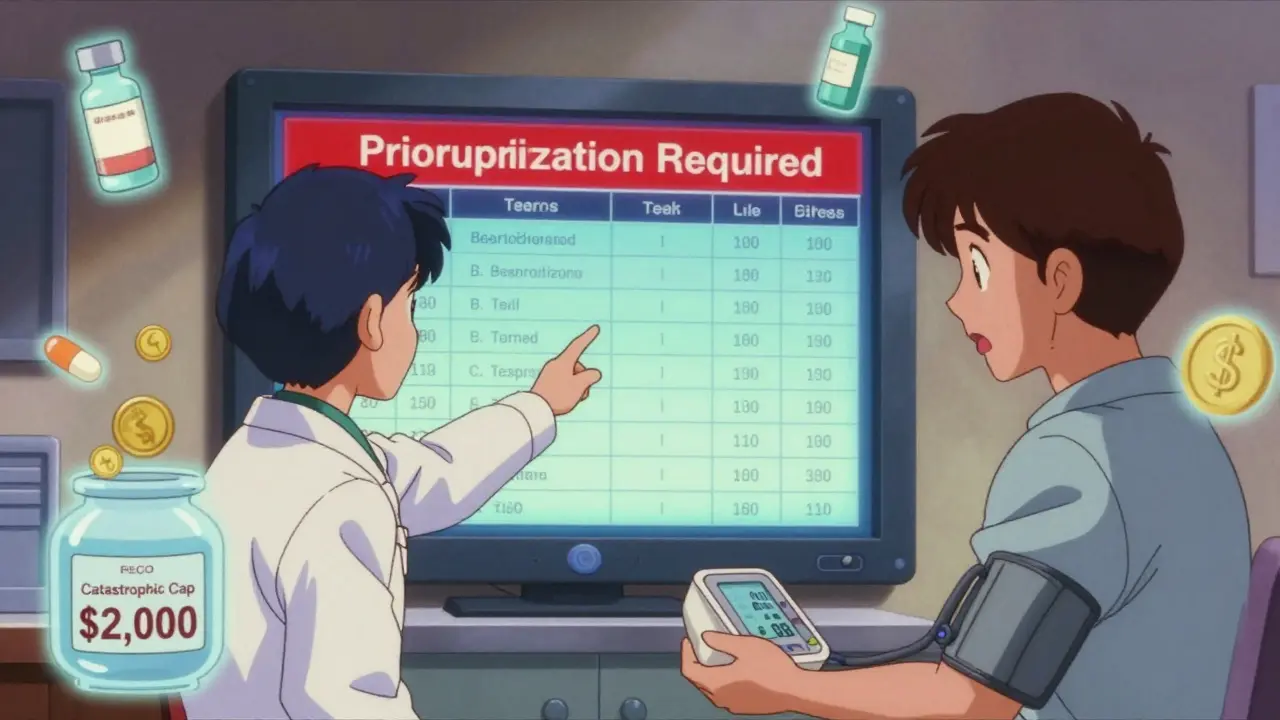

Cost-Sharing Rules Change Everything

In 2025, the big change? The “donut hole” is gone. You no longer hit a coverage gap where you pay 100% for drugs. Instead, there’s a hard cap: once you’ve spent $2,000 out of pocket on covered drugs, you enter catastrophic coverage-and you pay nothing for the rest of the year.

That changes substitution behavior. Before, people would delay switching drugs to avoid hitting the donut hole. Now, if you’re close to that $2,000 limit, your plan might push you toward cheaper alternatives-not just to save money, but to keep you from hitting the cap too early. Why? Because once you’re in catastrophic coverage, your plan pays more. So substitution isn’t just about cost-it’s about how the plan manages its own spending.

And here’s the catch: coinsurance vs. copay. Some plans charge a percentage of the drug’s price (coinsurance), not a fixed amount (copay). If your drug costs $500 and your coinsurance is 25%, you pay $125. But if the plan substitutes a $150 drug, you pay $37.50. That’s a huge difference. Copays are predictable. Coinsurance isn’t. That’s why you need to know how your plan calculates your share.

What You Can’t Switch Without Permission

Not all substitutions are automatic. Some require steps:

- Step therapy: You must try the cheapest effective drug first. If it doesn’t work, your doctor can request to move you up.

- Prior authorization: Your doctor must get approval from your plan before you can get a specific drug.

- Quantity limits: Your plan may only cover a 30-day supply unless your doctor justifies a larger amount.

For example, if you take a brand-name diabetes drug and your plan requires step therapy, you might be forced to try a generic version first. If your blood sugar doesn’t stabilize, your doctor files an appeal. That process can take days-or weeks. Meanwhile, you’re stuck without your usual medication.

Some drugs are off-limits for substitution entirely. Insulin, for example, has special rules. In 2025, Humana and other plans cap insulin at $35 per 30-day supply, no matter the tier. But you still can’t swap insulin types without a new prescription. You can’t swap Lantus for Humalog unless your doctor says so.

How to Avoid Surprises

Most people don’t realize their drug plan changes every year. A drug you got for $10 last year could jump to $85 this year-or disappear from the formulary entirely.

Here’s how to stay ahead:

- Check your formulary every October. Don’t wait until your refill runs out. Go to your plan’s website and search each drug you take.

- Call your pharmacy. Ask: “Is my current prescription covered under my plan? Is there a substitute?”

- Ask your doctor about alternatives. Say: “If my drug gets switched, what’s the next best option?”

- Use the Medicare Plan Finder. Enter your drugs, zip code, and pharmacy. It shows you exactly what each plan covers and how much you’ll pay.

- Don’t skip Open Enrollment. If your plan drops your drug, switch before December 7. You can’t change plans mid-year unless you qualify for a special enrollment period.

And if you’re on a Medicare Advantage plan with drug coverage (MA-PD), your substitution rules might be different than if you’re on a standalone Part D plan. MA-PDs often bundle medical and drug coverage, so substitutions might be coordinated with your doctor’s visits. That can be helpful-or confusing.

What Happens If You Get the Wrong Drug?

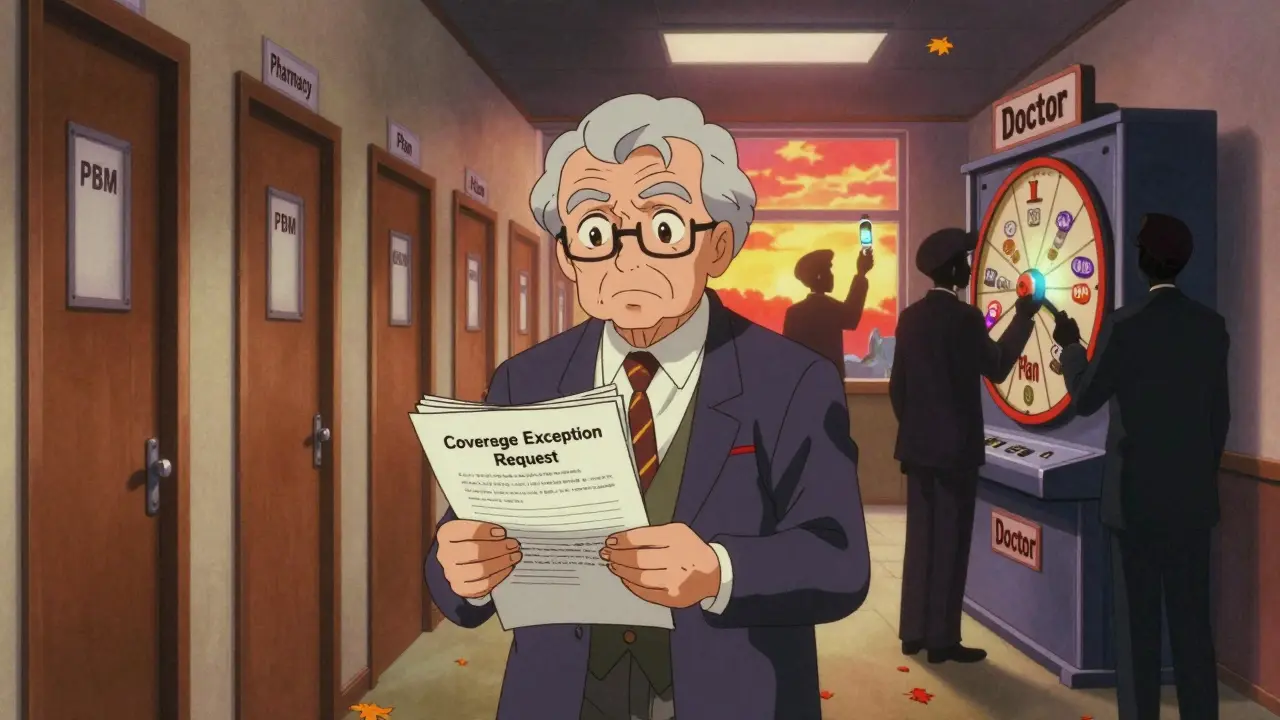

Let’s say you pick up your prescription and it’s not what you expected. You have rights:

- You can refuse the substitution.

- You can ask your pharmacist to contact your doctor for clarification.

- You can file a coverage exception request with your plan.

If your doctor says the original drug is medically necessary, your plan must cover it-even if it’s not on the formulary. You’ll need a letter from your doctor explaining why the substitute won’t work for you. This can take time, but it’s your legal right under Medicare rules.

Don’t assume your doctor knows what’s on your plan’s formulary. Most don’t. That’s why you need to be your own advocate. Bring your list of meds to every appointment and ask: “Will this still be covered next year?”

Why This Matters in 2026

The $2,000 out-of-pocket cap is rising to $2,100 in 2026. That means you’ll have a little more room before catastrophic coverage kicks in. But don’t assume that means more freedom. With fewer stand-alone Part D plans available (down 52% since 2015), your choices are shrinking. More people are on Medicare Advantage plans, which means substitution rules are becoming more standardized-but also more rigid.

Pharmacy benefit managers (PBMs) are the hidden players here. They’re the middlemen that negotiate drug prices with manufacturers and design your plan’s formulary. They don’t answer to you. They answer to the insurance company. And their goal is to reduce costs-not necessarily to give you the best drug.

The bottom line: Medicare Part D substitution isn’t about convenience. It’s about money. And if you don’t understand how it works, you’ll pay more, get the wrong drug, or go without treatment.

Can my pharmacist switch my Medicare Part D drug without telling me?

Yes, but only if it’s a generic substitution and your doctor didn’t write “Do Not Substitute.” For brand-name swaps or therapeutic substitutions, your pharmacist must contact you first. If you’re unsure, always ask: “Is this the same drug my doctor prescribed?”

What if my drug is removed from the formulary mid-year?

Your plan must give you 60 days’ notice. You can request a one-time refill of the old drug, file an exception, or switch to a covered alternative. If your doctor says the drug is medically necessary, your plan must cover it-even if it’s off-formulary.

Do all Medicare Part D plans have the same substitution rules?

No. Each plan creates its own formulary and rules. One plan might cover your drug with a $5 copay, while another doesn’t cover it at all. That’s why comparing plans during Open Enrollment is critical. Don’t assume your current plan is still the best.

Can I get a different drug just because it’s cheaper?

Not automatically. Your doctor decides what’s best for your health. Your plan can suggest a substitute, but you and your doctor have the final say. If you’re pressured to switch, ask for the clinical reason behind it-and get it in writing.

How do I know if a substitute drug is safe for me?

Ask your pharmacist or doctor to explain the difference between the original and substitute drug. Check for differences in side effects, dosing, or how the drug works in your body. For example, not all generic blood pressure pills work the same way for everyone. If you feel worse after the switch, speak up.

What to Do Next

If you’re on Medicare Part D, here’s your action list:

- Log into your plan’s website and download your 2025 formulary.

- Compare your current drugs to the list. Highlight any that are missing, moved to a higher tier, or require prior authorization.

- Call your doctor’s office and ask them to review your meds with you before December 7.

- If you’re on a Medicare Advantage plan, ask if your drug coverage is tied to your medical benefits-and how substitutions are handled across both.

- Don’t wait until you run out of pills. Switch plans now if you need to.

Medicare Part D substitution isn’t going away. It’s getting more complex. But you don’t have to be confused by it. Know your plan. Know your drugs. And never assume the pharmacist knows what’s best for you.

15 Comments

Wait-so if my pharmacist swaps my blood pressure med without telling me, and I start getting dizzy, who’s liable? I’ve had this happen twice. First time, I didn’t notice until my BP spiked. Second time, I caught it because the pill looked different. Why is this even legal?!

Oh wow, another ‘Medicare is saving you money’ fairy tale. Let me guess-next you’ll tell me PBMs are just nice middlemen who care about your kidneys. 😂

Newsflash: your ‘$2,000 cap’ is a trap. They’ll swap you to the cheapest drug even if it makes you hallucinate. Then they’ll pat themselves on the back for ‘cost containment.’

Meanwhile, your doctor’s too busy filling out 17 forms to even know what’s in your prescription bottle.

So true! 🙌 In India, we call this ‘formulary pressure’-but here, it’s masked as ‘care.’

Medicare Part D is like a game of chess where the insurance company moves all the pieces. You’re just the pawn with a $35 insulin cap and zero power.

Always check your formulary! I lost my dad’s diabetes med mid-year because they removed it. He had to wait 3 weeks for an appeal. 😔

Pro tip: Ask your pharmacist for the ‘non-preferred’ version. Sometimes it’s cheaper than the ‘preferred’ one. Crazy, right? 😅

Bro, this is why I tell my cousins in the US: ‘Don’t trust the system. Trust your papers.’ 🙏

I saw my aunt get switched from Humira to some generic biologic. She got rashes. Took 6 months to get back on the right one.

Always ask: ‘Is this the same molecule?’ If they hesitate? Walk out. 😎

Actually, this article is wrong. The ‘donut hole’ never really disappeared-it just got renamed to ‘catastrophic coverage.’ And yes, you still pay 5% coinsurance after the cap.

Also, insulin isn’t capped at $35 everywhere. Only if you’re on a plan that voluntarily adopted it. Most don’t.

And PBMs? They’re not ‘hidden.’ They’re public companies. You can look them up. Stop acting like this is some conspiracy.

My plan switched my antidepressant last year. I cried for a week. My doctor didn’t know. The pharmacist didn’t care. Now I keep a printed copy of my formulary in my purse.

bro i just got my script and it was a diff color pill and i was like wtf but i took it anyway now i feel weird

who even checks this stuff

It is not merely a matter of pharmacological substitution; it is a systemic erosion of patient autonomy under the guise of fiscal prudence. The Medicare Part D formulary, as currently structured, constitutes a quasi-regulatory apparatus wherein private entities-pharmacy benefit managers-exert de facto control over therapeutic outcomes without accountability to the patient or the physician.

The notion that a $2,000 out-of-pocket cap incentivizes substitution is not only economically illiterate but ethically indefensible. The cap functions as a threshold for cost-shifting, not patient protection. When plans encourage substitution to delay catastrophic coverage entry, they are not acting in the interest of health-they are acting in the interest of actuarial optimization.

Furthermore, the reliance on step therapy, while ostensibly evidence-based, often ignores inter-individual pharmacogenomic variability. A generic beta-blocker is not interchangeable with another in a patient with comorbid asthma and atrial fibrillation.

The absence of mandatory pharmacist disclosure regarding therapeutic interchange is a glaring regulatory failure. No other sector of healthcare permits such unilateral substitution without informed consent.

What we are witnessing is not innovation. It is commodification.

My mom got switched to a generic statin. She developed muscle pain so bad she couldn’t walk. Took three months and three appeals to get her old one back.

They don’t care. They don’t track outcomes. They just track dollars.

And when you complain? They send you a 12-page form to fill out. In 8-point font.

Don’t trust the system. It’s designed to make you give up.

Medicare Part D? More like Medicare Part Profit.

They’re not trying to help you. They’re trying to make you forget you’re being played.

And don’t even get me started on how they force you into Advantage plans. It’s not choice-it’s coercion.

They want you to think you’re getting a deal. You’re not. You’re getting a leash.

And if you think your doctor’s on your side? They’re getting paid by the same system that’s swapping your meds.

Wake up. This isn’t healthcare. It’s a market.

Therapeutic equivalence is a pharmacoeconomic construct, not a clinical one. Bioequivalence studies demonstrate AUC and Cmax equivalence, but they do not account for inter-patient variability in drug metabolism, comorbidities, or polypharmacy interactions.

When a Tier 2 generic is substituted for a Tier 3 brand, the assumption of clinical interchangeability is statistically valid at the population level but clinically invalid for the individual.

Formulary design prioritizes marginal cost reduction over therapeutic fidelity. This is a systemic misalignment between actuarial risk modeling and clinical outcomes.

Further, the absence of real-time formulary updates at the point of dispensing introduces significant medication error risk.

Recommendation: Implement mandatory EHR-integrated substitution alerts with clinician override capability.

They’re swapping your meds to make you sicker so you need MORE drugs. 😈

It’s all connected. PBMs, Big Pharma, Medicare. They want you on 5 pills, not 1.

That ‘$2,000 cap’? It’s a trap. Once you hit it, they start pushing you into specialty drugs. Then you’re hooked.

And don’t think your doctor doesn’t know. They’re paid to stay quiet. 🤫

Check your pills. Always. They’re watching. 😳

Look, I’m a vet. I’ve been on Medicare since 2020. I’ve had 4 different drugs swapped out on me. Once, I got a pill that looked like a Skittle. I didn’t even know it was supposed to be for my heart.

So I called my doc. He said, ‘Oh yeah, that’s the new one. Cheaper.’

I said, ‘Does it work the same?’ He said, ‘Probably.’

That’s not medicine. That’s a lottery.

And yeah, I switched plans. Took me 3 hours on the phone. Worth it.

Just wanted to say-I used the Medicare Plan Finder last week and found out my plan was dropping my thyroid med. I switched before Open Enrollment ended and saved $90/month. 😅

Also, my pharmacist called me to say they were switching my blood thinner. I said no. They called my doctor. Done.

It’s not hard. Just be annoying. You deserve better.

How is it that we’ve allowed a system where a pharmaceutical middleman-some soulless, spreadsheet-wielding entity in a cubicle in New Jersey-decides whether your life-saving drug is ‘cost-effective’ enough for you to receive?

This isn’t healthcare. It’s corporate eugenics dressed in Medicare blue.

And you? You’re just a line item with a pulse.

Wake up. The system doesn’t want you healthy. It wants you profitable.